how to pay indiana state withholding tax

As previously stated Indiana is a state that allows you to use Form W-2G for your state income tax return as well. Dor Your State Tax Dollars At Work Pin On Payroll Blogs Irs Form W8 Irs Tax Forms Withholding Tax Irs.

Pass Through Entity And Trust Withholding Tax

How to pay indiana state withholding tax Sunday March 6 2022 Edit.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

. This report is a good source of information used to balance wages and taxes withheld from prior quarters. Taxes should be withheld from a taxpayers paychecks throughout the year at a rate equal to the total of the state and county rate but youll still need to file a state income tax. You can pay those Indiana state taxes due directly online to Indiana at the web site address here select Individual Tax Return.

The county tax rate will depend on where the employee resided as of January 1. State Tax to Withhold 61731 x 0323 1994 County Tax to Withhold 61731 x 01 617 Note. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient.

Find Indiana tax forms. Httpsdorpaydoringov View solution in original. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

A new user field labeled. Generally county income tax should be withheld based on each employees county of residence on NewYears Day of each year. 2 Number of exemptions claimed for certain qualifying dependents.

To do so transfer the amount from Line 7 of your Federal 1040 to Line 1 of. The WH-1 is the Indiana Withholding Tax Form and is required for any business that is withholding taxes. To register for Indiana business taxes please complete the Business Tax Application.

WH-1 Indiana Withholding Tax Form. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources.

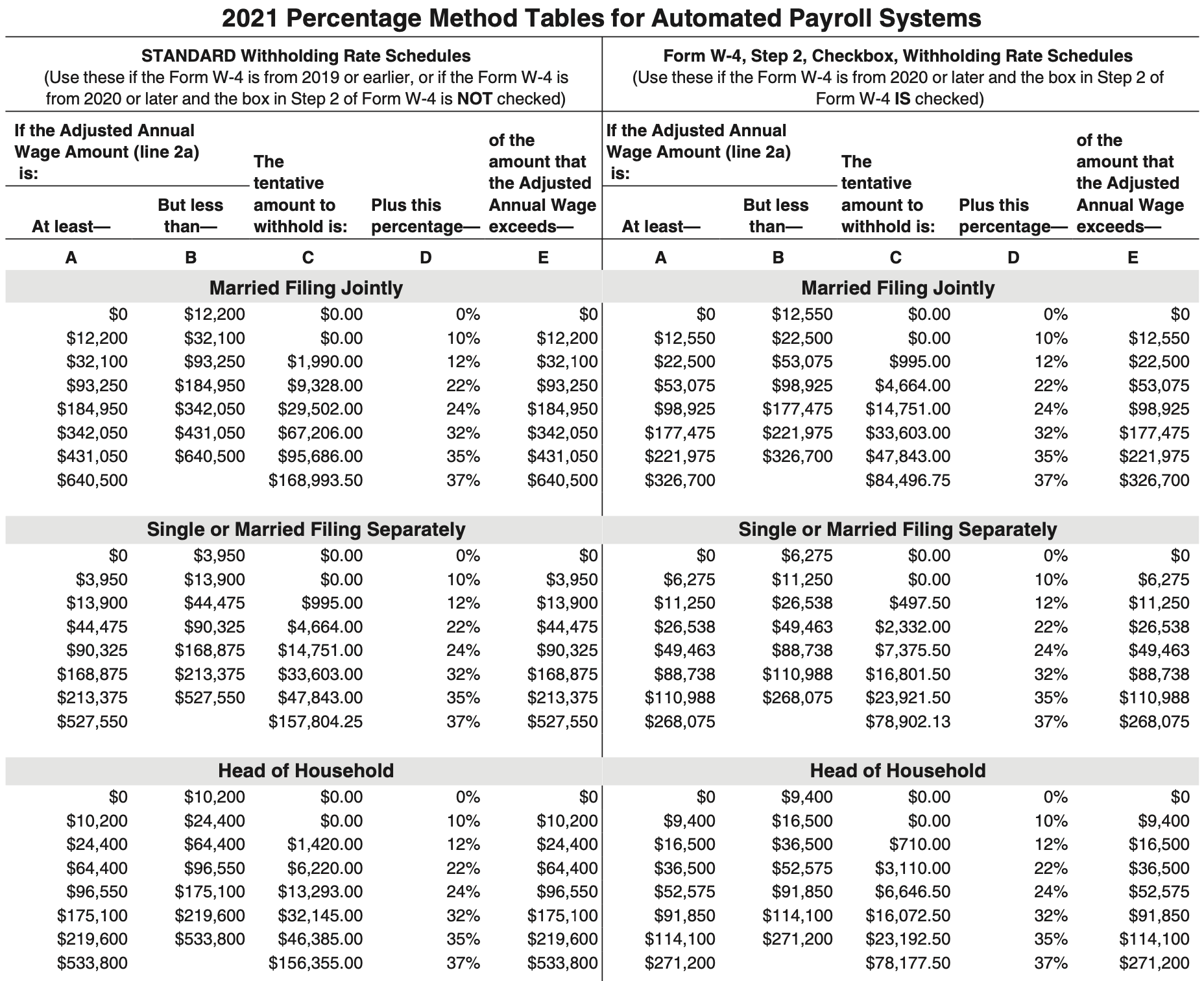

Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown. However as of 2013 all Indiana. Multiply the taxable income computed in step 4 by 323 percent to obtain the annual Indiana tax withholding.

Income Tax Information Bulletins which may be of assistance with withholding tax. In addition the employer should look at Departmental. Departmental Notice 1 explains how to withhold taxes on employees.

Print or type your full name Social Security number. If an employee resides in Lake County the only Indiana county. You may also need to complete the FT-1 application for motor fuel taxes including special fuel or.

To register for withholding for Indiana the business must have an Employer Identification Number EIN from the federal government. Know when I will receive my tax refund. Formerly many Indiana withholding tax payers could pay on paper by sending in Form WH-1 Indiana Employers Withholding Tax Return with a check.

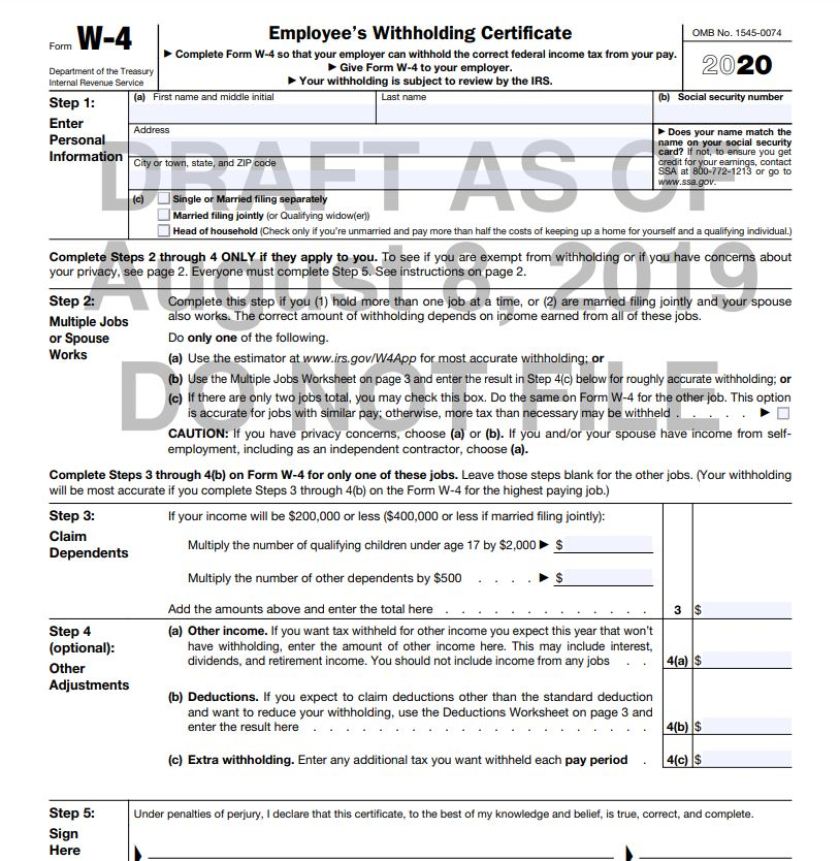

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax. To help QuickBooks Desktop Payroll Enhanced subscribers who file the Indiana WH-1 and WH-3 tax forms QuickBooks Payroll is adding. This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax.

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

Calculating Your Withholding Tax Inside Indiana Business

How To Calculate Payroll Taxes Step By Step Instructions Onpay

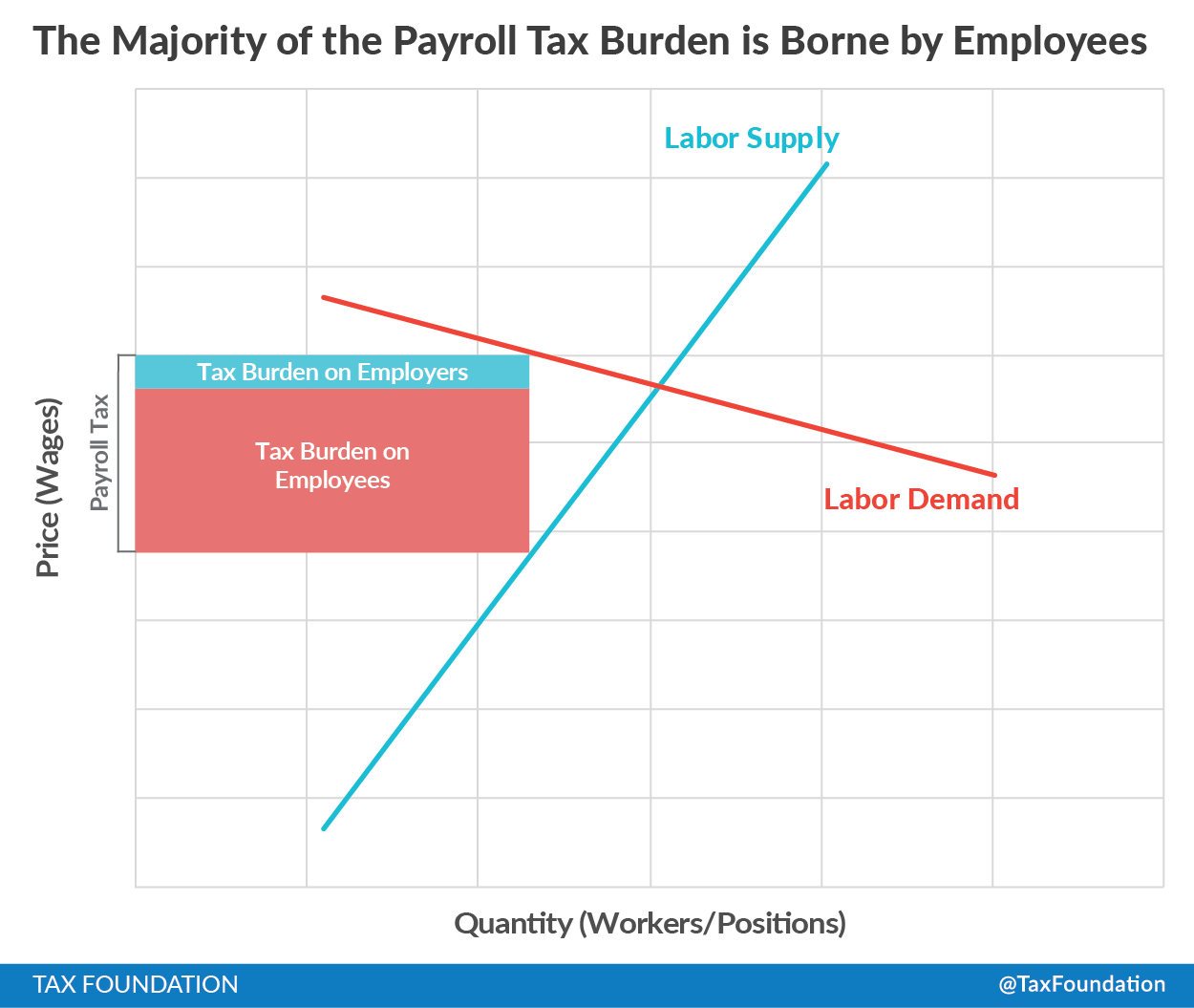

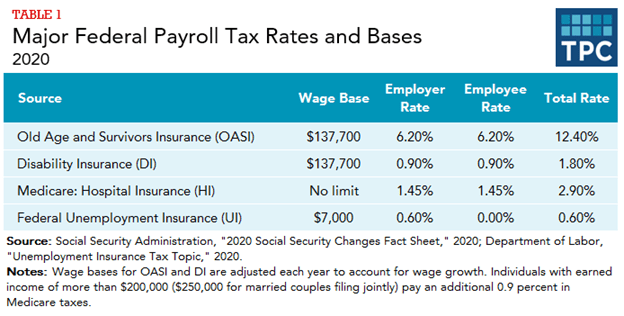

What Are Payroll Taxes And Who Pays Them Tax Foundation

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

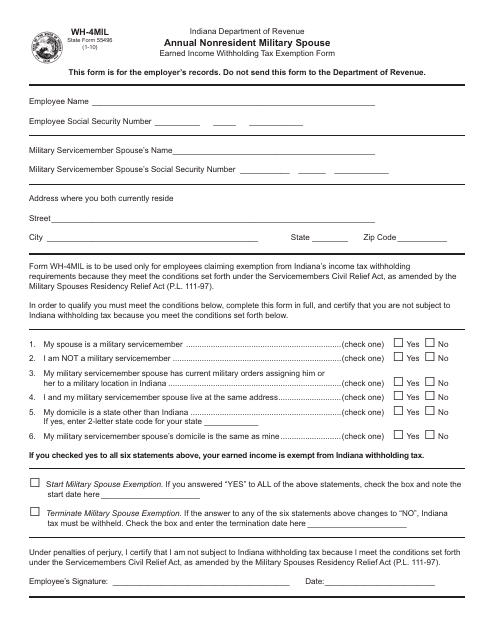

State Form 55496 Wh 4mil Download Fillable Pdf Or Fill Online Annual Nonresident Military Spouse Earned Income Withholding Tax Exemption Form Indiana Templateroller

Wht Definition Withholding Tax Abbreviation Finder

State Of Ohio Refund Cycle Chart 2014 29 Louisiana State Tax Forms Picture Louisiana State Tax Forms Chart State Tax

State W 4 Form Detailed Withholding Forms By State Chart

Payroll Tax Vs Income Tax Payroll Taxes Payroll Income Tax

Colorado W4 Form 2021 In 2021 Irs Forms Payroll Taxes Federal Income Tax

Payroll Tax What It Is How To Calculate It Bench Accounting

New In 2020 Changes To Federal Income Tax Withholding Tilson

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

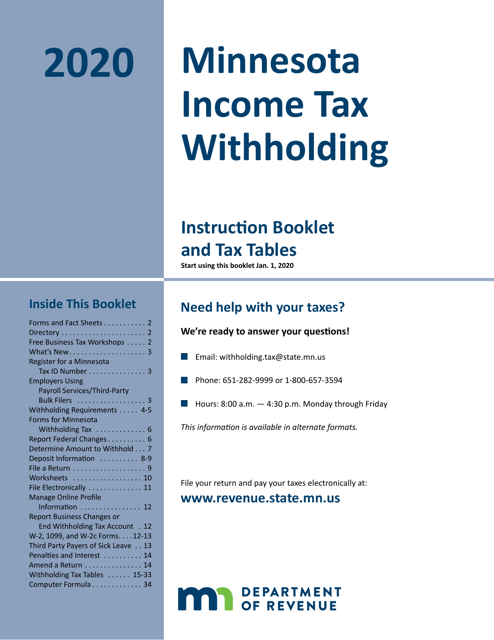

2020 Minnesota Minnesota Income Tax Withholding Download Printable Pdf Templateroller